MarketNsight, a leading real estate data and analysis provider, reports that June’s collapse in housing inventory ushered in 2023’s first significant price increase. In late June, total inventory turned negative year over year for the first time in 13 months. Two weeks later, the effect of this drop in inventory was reflected in prices.

Prices in July 2023 were up 6% over July 2022, and year to date, prices are up 1% over 2022. MarketNsight forecasts a continued decline in inventory year-over-year, with prices remaining positive for the rest of the year, possibly nearing the 50-year appreciation average of 4% to 5%.

According to John Hunt, Principal and Chief Analyst at MarketNsight, even though inventory increased with the rapid rise of interest rates, it is still 50% below pre-pandemic levels. He comments, “The gloom and doom you read in the news is just clickbait. It seems that many prognosticators have forgotten the basic principles of supply and demand. When supply is scarce, prices rise. Even with interest rates at 20-year highs constraining demand, we still do not have enough supply.”

Of note, July 2023 prices were up 18% over July 2021, 43% over July 2020 and 55% over July 2019.

Hunt reiterated, “There was already a housing shortage before the pandemic. The pandemic housing boom made it worse, and the Fed’s actions have only deepened the inventory crisis.”

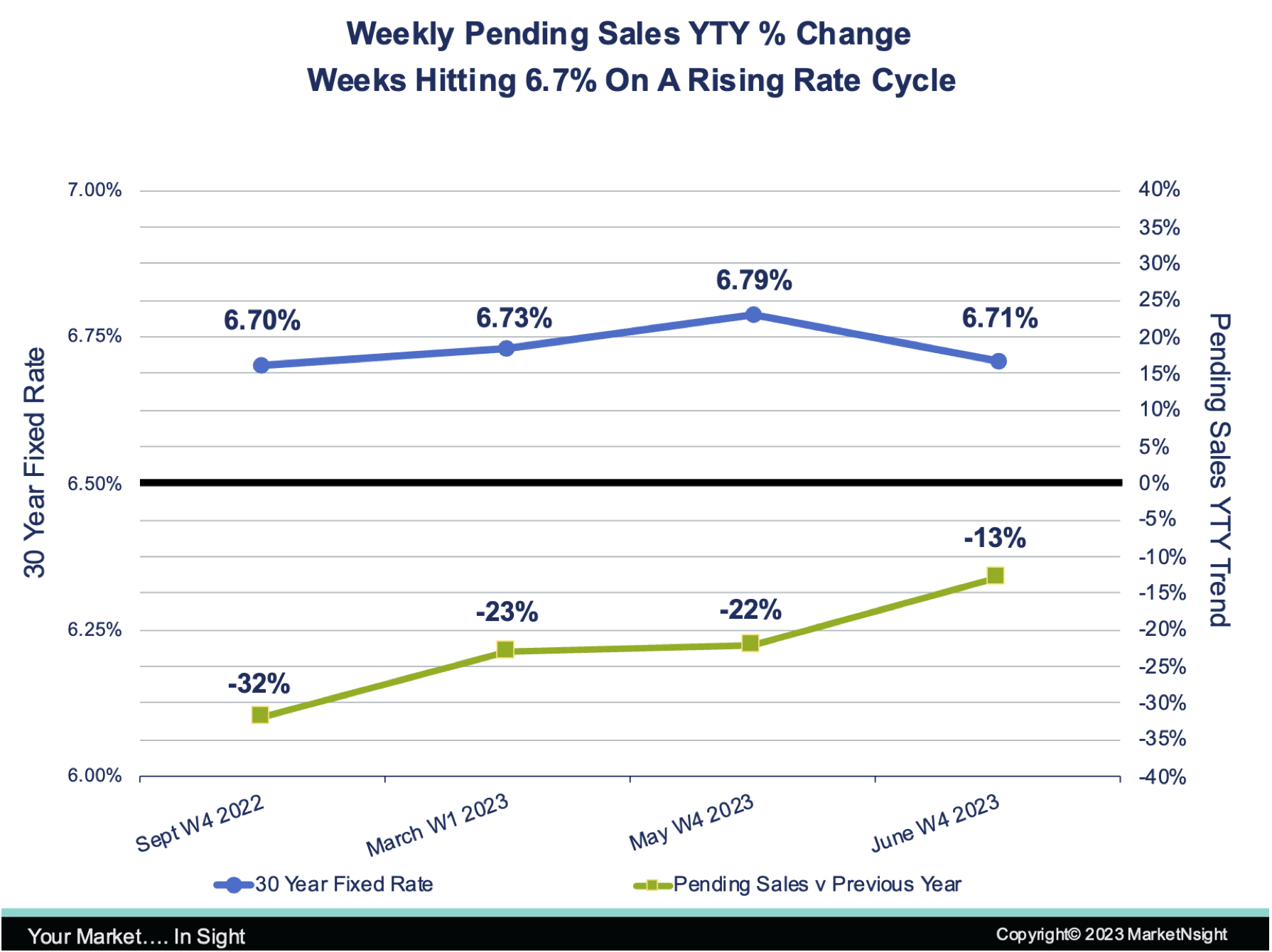

To illustrate how buyers are coming to terms with higher rates and returning to the housing market over time, MarketNsight looked at the effect on pending sales every time rates hit 6.7% on a rising rate cycle since June 2022. Rates hit this level in the fourth week of September 2022, the first week of March 2023, the fourth week of May 2023 and the fourth week of June 2023.

When rates hit 6.7% for the first time in 15 years in the fourth week of September 2022, pending sales collapsed and were down 32% year-over-year. By the time rates rose to the same level most recently, in the fourth week of June 2023, pending sales were only down 13% year-to-year. Hunt comments, “In other words, buyers are getting used to higher rates.”

The severe lack of resale inventory continues to push buyers toward new homes. This trend, first identified by MarketNsight in March 2023, is excellent news for the new home industry.

About MarketNsight:

MarketNsight currently serves 40+ cities in nine states – Alabama, Florida, Georgia, Louisiana, North Carolina, South Carolina, Tennessee, Texas and Virginia. Look for the addition of more cities soon!

To schedule a demonstration of the MarketNsight Feasibility Matrix® or Mortgage Matrix®, call 770-419-9891 or email info@MarketNsight.com. For information about MarketNsight and John Hunt’s upcoming speaking engagements, visit www.MarketNsight.com.