Flashback to February 2013 when Atlanta Real Estate Forum ran this headline: Is Atlanta Running Out of Houses? Times were different, yet there were so many similarities. Home inventory in Atlanta was getting depleted quickly, and it is once again now 10 years later!

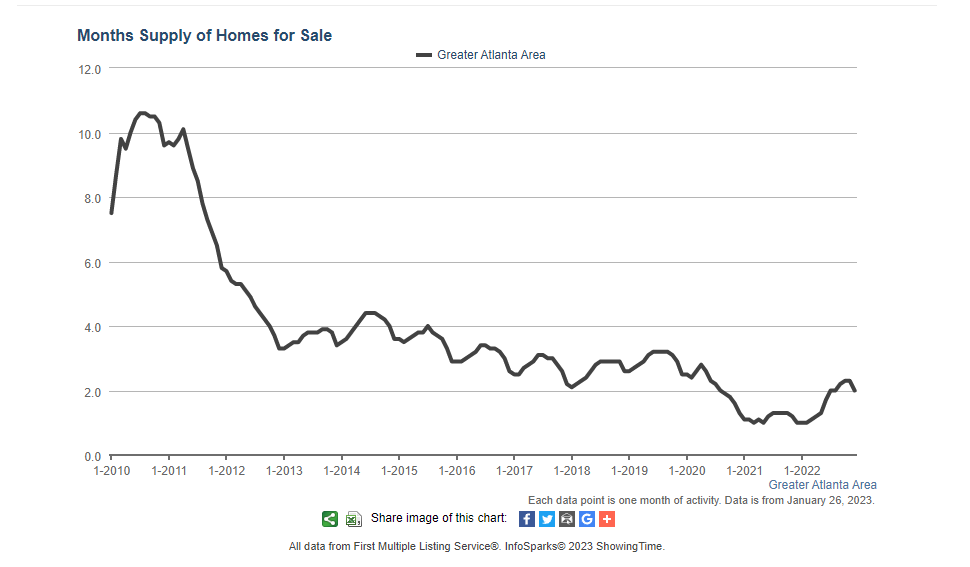

In February 2013, when this article was originally published, you’ll notice the months supply of homes for sale was 3.4. At the end of December 2022, it is 2.0 months. So that trend has been slowly declining year over year since recovery from the recession. On the other hand, new home starts are trending upward, as is construction of for-rent apartment complexes.

Based on recently released statistics, some people might come to the conclusion that the Atlanta real estate market is running out of houses for sale. On the surface, this appears true. So let’s look at a 10-year comparison and “go back to the future!”

Home Inventory 10 Years Ago

Way back in 2013, the number of resale homes, townhomes and condominiums for sale based on the First Multiple Listing Service (FMLS) database showed only a three-month supply of homes available. This was the lowest amount of inventory on record – just wow! Historically, Atlanta has had a six to seven-month supply of homes, and that is what is considered “normal.” Home inventory surged to almost 14 months during the peak of the Great Recession in mid-2008. The 2013 number indicated that Atlanta was, at the time, a seller’s market for properly priced, good-condition homes in desirable locations.

This decrease in supply led to a rise in overall resale prices (including foreclosures) of 6.5 percent in 2012. Local Realtors also reported multiple offers and the occasional bidding war on the best-priced and most desirable homes.

Completed unsold new construction by homebuilders also decreased, and at the end of 2012, had reached what market observers consider a historical equilibrium of 3.6 months supply. This is versus an almost one-year supply of vacant new homes available in 2007.

Home Inventory in 2023

For perspective on where we are now, we reached out to Jeremy Crawford, CEO and President of FLMS and here is his insight! We closed 2022 with only a two-month supply of homes for sale in the metro Atlanta area. That was double the supply at the end of December 2021, when we hit an all-time low.

Following the burst in 2008, inventory levels hovered around 13 months. Most economists agree the market fully recovered in late 2012. Since that time, the housing supply averaged roughly three months. Pre-recession we felt like a “normal” inventory was close to six months of supply. We haven’t been anywhere near that for the last 10 years. Inventory remains constrained, but it is generally trending up.

Regardless, we are still in a seller’s market. Average sales prices continue to rise, although not at a record pace as we saw during the peak of the COVID-19 pandemic. Plus, new home starts and construction of rental complexes are trending upward. So, we are not running out of houses in the Atlanta area, but we are nowhere close to the buyer’s market and frenzy of 2007.

All of these statistics are encouraging for the overall housing market in Atlanta. While short and possibly midterm inventory availability is definitely tightening, with increased home prices, we will likely see a slow stream of homes coming to the market. Homeowners who need to sell will start putting their homes on the market. In addition, homebuilders will continue ramping production as demand increases and banks start lending again.

Corelogic’s Chief Economist, in a presentation at FMLS FirstLook in Atlanta on January 26, 2023, gave the following market summary:

- 2023 will be a challenging year for the home purchase market, but signs of improvement are flashing green.

- Homeowners are well-positioned to weather a shallow recession.

- Mortgage rates have gone up much more than the Treasury rates this year. Expect mortgage /Treasury spreads to eventually decrease.

- Pre-Covid challenges persist with constrained for-sale inventory.

- Home price growth and home buying trends will return to long-run average in most markets.