Keeping with its trend to be ahead of the curve and set accurate benchmarks that are used nationally, MarketNsight released May numbers for Atlanta and the Southeast at MarketWatch Atlanta.

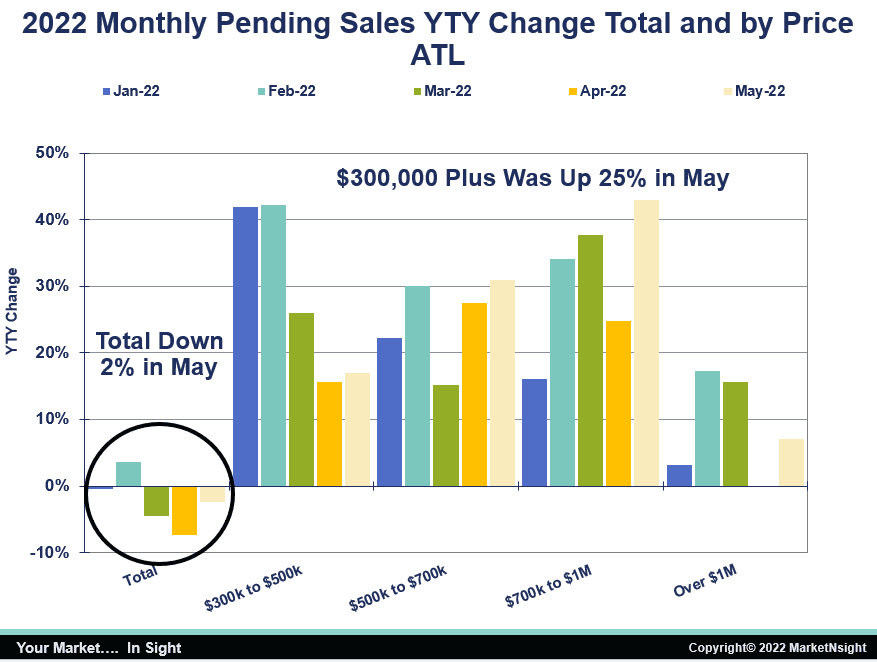

Total pending sales went negative year over year in April but improved in May, and Atlanta was only down 2%. Most shockingly, home closings at $300,000 and above are up 25% in May year over year.

“The devil is in the details,” MarketNsight Principal, Founder and Chief Analyst John Hunt said. “The national reports that show the market off aren’t taking lack of supply by price point into account. There is simply nothing left to buy at $300,000 and below in Atlanta or any other major city.”

There is currently 0.6 months of supply at $300,000 and below in metro Atlanta. This is not a new trend, there was very little supply in 2021 at this price point as well.

High-end homes took a massive hit when the COVID-19 (coronavirus) pandemic started, but price points above $300,000 have more than recovered. Home sales have not been deterred by the stock market or rising interest rates.

“If we had inventory available under $300,000, we would be up huge,” Hunt said.

In polls of MarketWatch Atlanta participants, responses show that 85% of home builders still don’t have enough inventory available to sell to eager buyers.

“We are witnessing an all-out war on housing affordability in our country,” Hunt said. “It is structural and institutional in nature. It is being waged not by rising material costs or rising interest rates, inflation or labor costs. It is being waged by the restrictive and exclusionary zoning tactics of municipalities everywhere.”

MarketNsight data shows that the war on homes at $300,000 and below is not unique to Atlanta. There are massive shortages at this price point in Augusta, Georgia; Dallas, Texas; Nashville, Tennessee; Raleigh, North Carolina and Jacksonville, Florida as well.

“This is going on everywhere,” Hunt said. “It is effectively the extinction of the entry-level home.”

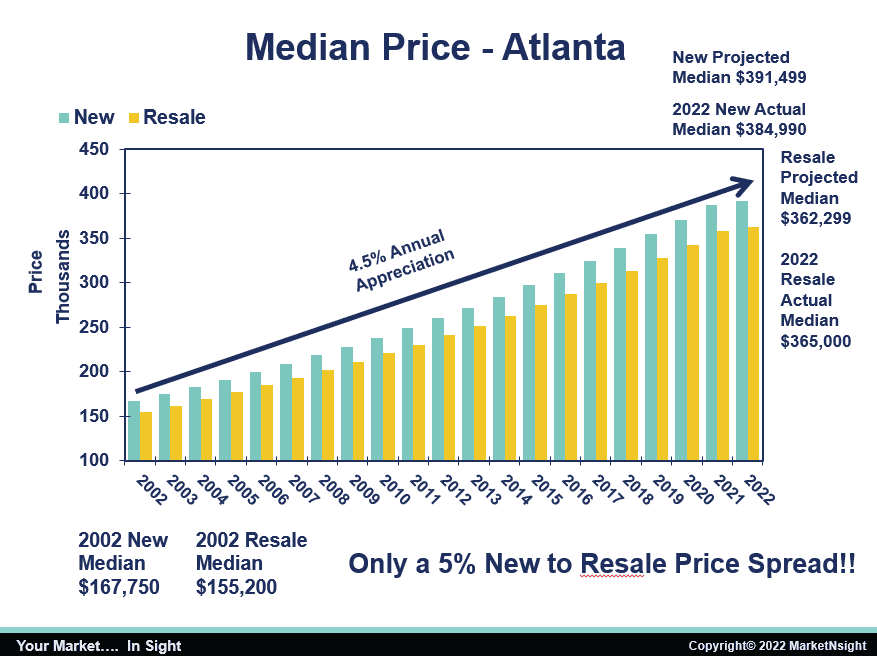

Are homes overpriced or overvalued? MarketNsight says no, we are right where we should be. Using 2002 as the last normal year before the subprime bubble and collapse and running those numbers out at 4.5% annualized appreciation year over year shows the story:

- Median new home price in 2002: $167,750 at 4.5% annual appreciation today is: $391,000 (using deeds MarketNsight shows today’s actual median price is $384,900).

- Median resale home price in 2002: $155,200 at 4.5% annual appreciation today is: $362,299 (using deeds MarketNsight shows today’s actual median price is $365,000).

Hunt’s forecast for the rest of 2022:

“Zero inventory is a game-changer. Even if rates continue to rise, there is not enough inventory to cause a crash.

“Millennials are a huge demographic group. This demand pressure is not going away. Especially combined with the fact that Boomers are sitting on their homes when they should be selling to take advantage of skyrocketing prices. They don’t want to risk being homeless or trading in their 3% mortgage for one that is 5%.

“We are set up for moderate sustainable growth based on job growth and household/population growth. New home construction cannot even begin to touch the 89,000-inventory deficit in Atlanta.”

Permits are down 14% year over year, but they are not down due to lack of demand. The industry is struggling to bring new communities online. Hunt predicts Atlanta will end the year down 14% for a number of reasons. Builders have throttled back starts on purpose and the inability to replace deals at the right price. However, he predicts the missing 4,000 permits will show up somewhere else most likely in secondary or tertiary markets like Augusta, Columbus, Macon, Savannah or Valdosta where permits are up for the year. These cities offer more affordable homes because the cost of development is less.

“After all, today you can live and work from anywhere,” Hunt said.

National headlines declare, “Brace yourself for an economic hurricane.”

“Are you kidding me?” Hunt said. “We just survived and thrived in a once-every-100-year pandemic that shut the world down. Our industry showed the world how to sell remotely. We survived that and can’t survive a little inflation and 5 to 6% interest rates? I think we can!”

In 2013, 75% of all new home sales were in the six core counties. Now only 50% of new home sales happen in these counties as buyers and builders continue to push farther out due to affordability.

While other national forecasters and economists predict the market is going to collapse because it is overbuilt, MarketNSight predicts 2022 will be another year where our ability to supply falls short of the demand.

MarketNsight is focused on helping its customers make smart decisions as it relates to purchasing land and pricing product. Its groundbreaking Feasibility Matrix provides a one-stop-shop for gauging new home community feasibility by providing ranking reports, lot and raw land sales data, regression analysis and mortgage data.

To learn more or to schedule a demonstration, visit www.MarketNsight.com.