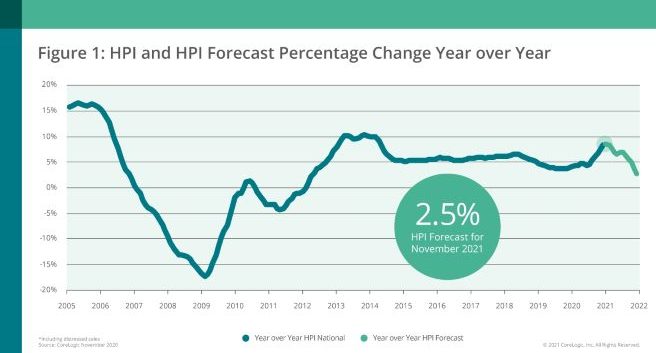

CoreLogic®, leading global property information, analytics and data-enabled solutions provider, recently released its Home Price Index (HPI™) and HPI Forecast™ from November 2020. In the reports, CoreLogic® found that when compared with November of 2019, home prices increased on average 8.2%. This impressive national rise in home prices is the largest annual appreciation in the housing market since March of 2014.

Although the home price growth remained elevated and consistent throughout 2020, home sales are expected to register well above the 2019 numbers. In addition, the COVID-19 (coronavirus) pandemic helped increase the trend for buying new homes, leaving the new home inventory low. This has delayed sellers from putting their homes on the market.

“The housing market performed remarkably well in 2020 despite the volatile economic state,” said Frank Martell, president and CEO of CoreLogic. “While we can expect to see lingering effects of COVID-19 resurgences and subsequent shutdowns in the early months of 2021, vaccine distributions and stimulus actions should revitalize economic activity and keep home purchase demand and home price growth strong.”

For many, the COVID-19 pandemic has left citizens in a position of financial insecurity due to job loss and an unpredictable job market. For others who continued to maintain steady employment and a steady income, the record-low mortgage rates were a high driving incentive to buy new homes. This along with the rise in home prices leading to higher down payment requirements has intensified the housing market’s affordability issues.

“The demographic tailwind has arrived as Generation X and millennials drive housing demand,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Lower-priced home values increased about one and a half times faster than higher-priced home values in November, as first-time buyers tend to seek out homes within the lower price ranges.”

In 2021, the CoreLogic® HPI Forecast predicts a slowing in buyer demand accompanied by a higher supply of new homes. The Forecast also shows a slowing in annual home price growth, reducing from 7.5% in the first quarter of 2021 down to only 2.5% by November of 2021. This prediction could be changed due to possible stimulus actions designed to help spur the economy.

The HPI Forecast also predicts a discrepancy in home price growth in different cities due to a variety of outside factors. The Houston market saw big change due to the collapse of the oil industry and the recent hurricane season. Because of this, home prices in this market are expected to decline by 1.4% by November 2021. In San Diego, a low housing inventory is predicted to increase prices, inclining the home price growth of 8.3% over the next year.

According to the CoreLogic® Market Risk Indicator (MRI), Miami; Lake Charles, Louisiana and Prescott, Arizona are at the greatest risk to see a decline in home prices over the next year. The CoreLogic® MRI is a monthly update on the overall health of housing markets across the country.

To read more about economic and housing trends on Atlanta Real Estate Forum, click here.