Today I have the pleasure of being at the Home Builders Association of South Carolina’s summer board meeting in the beautiful city of Savannah, Georgia. Economist Elliot Eisenberg, Ph.D., is speaking this morning on the 2018 Economy.

Here are some of his key points. The economy is not good, it is fantastic! This is probably the best quarter for GDP we have had in years. However, when we look to the future, it doesn’t look as good.

So, keep these two things in mind: we have a really good present and a much more dicey future (late 2019).

Why am I happy? What makes me feel good? The economy is solid.

- Job growth is good, overtime wages are good, wages are going up. The economy is growing at 5 – 6 percent a year.

- Corporate investment is doing well because tax cuts have make investment in plant and equipment more feasible.

- We are late in the business cycle; we have entered the 10th consecutive year of growth.

- Two things are driving this growth – the first is tax reform, as our paychecks are going up. Companies are starting to understand how to use the tax code to their advantage. And, spending is up by the government.

- Exports have done surprisingly well. It is a rare moment where everything is going in the same direction.

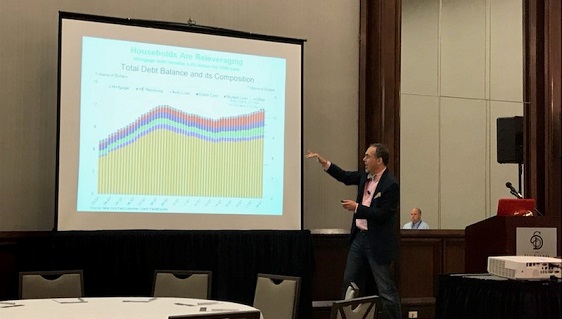

Households are repairing their balance sheets. But spending is not up. Why? Well, first of all, we are getting older and as we get older, we spend less. We are still traumatized by the great recession. Increasing wealth inequalities are pushing down GDP a little. We are borrowing more money. Total household debt is back to pre-recession levels, but we have the capacity to borrow. Household balance sheets are good. The national debt, not so much!

Student loans are the second biggest liability on the household balance sheet after mortgages. A car loan combined with a student loan is 20 percent of all debt! And, these loans are being accrued by those under age 21. This affects their ability to get a mortgage. Mortgages are not delinquent, but delinquency rates for autos and credit cards are headed up. This is not good.

This will be the longest recovery in history and we will slow down in late 2019.

Small business confidence is super strong. Why? Trump was elected and small business went wild. He put tax cuts in place and has started to roll back Obamacare.

We are traveling more. We are going to hotels, visiting Vegas and going on cruises. And, we are buying automobiles. We aren’t going to break any records for auto sales going forward, but sales are very solid. Two thirds of the sales of autos are now not cars; they are SUVs and crossovers because we are all fat cats. And, we are buying RVs — expensive, bulky, discretionary purchases.

Home repairs and renovations are growing at 7 or 8 percent a year. We have home equity loans and they are deductible. If you can’t be with the one you love, love the one you are with. I can’t find my dream home, so I will turn my current home into my dream home.

We are buying lots of other discretionary items, including race horses. All of this combined makes for a very happy economy. This is why Q2 will be good and they rest of this year will be good. It will remain good until late 2019.

For more information on Elliot Eisenberg, Ph.D., President of GraphsandLaughs, LLC or to book him to speak at your event, visit www.econ70.com.