The 2018 Fall Homebuyer Insights Report from Bank of America shows that 72 percent of millennials continue to approach life differently than generations before them as they prioritize life differently. Millennails value homeownership over almost everything else including marriage (50 percent) and having children (44 percent).

These 23- to 40-year-old millennial buyers also associate the purchase of a home with being mature (47 percent), acting like an adult (47 percent), and feeling independent (36 percent).

D. Steve Boland, head of Consumer Lending at Bank of America, says, “Younger generations tell us that owning a home has become a milestone that defines their success, and it’s promising to see them aspiring to homeownership.”

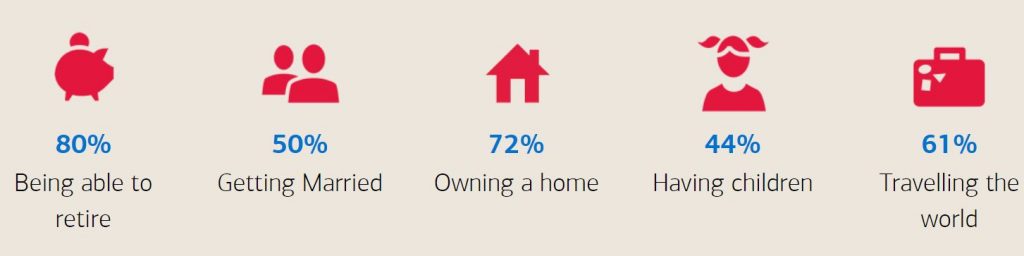

Top Millennial Priorities:

- 80% – being able to retire

- 72% – owning a home

- 61% – traveling the world

- 50% – getting married

- 44% – having children

Currently, about two-thirds of millennials don’t have retirement savings, according to a 2018 report by the National Institute on Retirement Security. Millennials who do have retirement savings hold a median balance of $19,100.

The BOA survey also looked at millennials who are currently renting but plan to someday own a home. The age-old question of whether it is better to rent or buy is definitely a toss-up for this group, with 49 percent believing renting long-term will be more expensive than buying a home, and 51 percent saying renting is less expensive than owning. That said, 69 percent believe and understand that rent will continue to increase. What eludes them is that a 20- or 30-year traditional mortgage won’t increase annually and that over time, they will build equity in an asset.

Finances remain one of the top barriers to homeownership for renters, with nearly half (44 percent) feeling they don’t have enough money for a down payment. What’s more, 23 percent cite they cannot afford the home they want.

Top renter misconceptions include:

- 49% believe that 20 percent down is required to buy a home.

- 43% believe they must pay private mortgage insurance if they don’t put 20 percent down.

- 25% believe they need a “perfect” credit score to be considered for a mortgage.

Millenials value homeownership and are thoughtful as it relates to home buying as they think through who to buy with, when to buy and where to buy. 57 percent of all first-time buyers plan to buy with a spouse or partner, while others are increasingly venturing out on their own, with 37 percent saying they plan to purchase their first home alone.

Regardless of who they are buying with, first-time buyers are ready to act soon. Nearly two in five plan to buy in the next two years, and 60 percent of those soon-to-be buyers are already saving for a down payment.

Location is also a big part of the plan. Ninety percent of first-time buyers would rather pay more for their preferred location than be in a less desirable location with lower home prices (10 percent). And 45 percent are looking to stay within their current neighborhood, city, county or township/school district, while just one in five is planning to buy out of state.