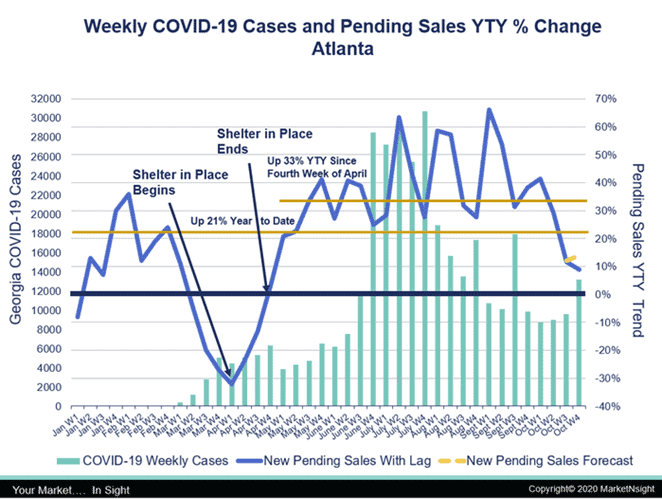

MarketNsight reports the slight new home moderation it predicted in September showed up in force for October. The progression from October week one to October week four year-to-year was: +41%, +29%, +12% and +14%. The third and fourth week of October 2020 mark the first time since the second week of May new pending sales have been less than 25% ahead of last year.

MarketNsight reports the slight new home moderation it predicted in September showed up in force for October. The progression from October week one to October week four year-to-year was: +41%, +29%, +12% and +14%. The third and fourth week of October 2020 mark the first time since the second week of May new pending sales have been less than 25% ahead of last year.

“Was this caused by massive price increases or the lead up to the election? No, and no,” MarketNsight and ViaSearch President John Hunt said. “Importantly, resale pending sales did not drop in October. If the election were a factor, resale would have also been affected, especially since resale accounts for 80% of all demand.

As for price, new list prices are flat year-to-year since January. Resale list prices are up year-to-year 9% since January. Again, strong evidence that price is not the reason for the drop-off in new homes.”

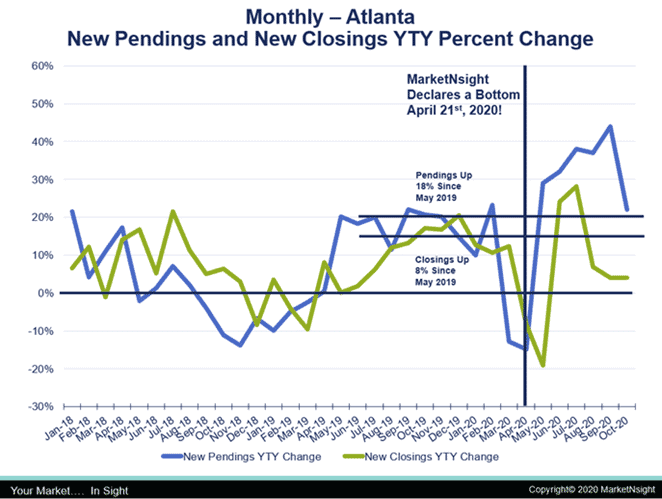

New home closings also dropped unexpectedly in October. Closings always follow pending sales in normal times. However, starting in August after being up 25% and 29% the previous two months, new closings unexpectedly dropped dramatically while pending sales continued to rise.

New home closings also dropped unexpectedly in October. Closings always follow pending sales in normal times. However, starting in August after being up 25% and 29% the previous two months, new closings unexpectedly dropped dramatically while pending sales continued to rise.

In essence, the lagging indicator became the leading indicator and new pending sales were forced to follow closings down at the end of October. Once again, this same decline was not seen in resale closings.

“The sharp drop off in new closings and pending sales was not caused by lack of demand, price increases, or the election,” Hunt said. “The only answer left is lack of supply. Resale inventory is “On Demand” or “Just in Time” inventory. One can decide to list their existing home in a matter of seconds using a Realtor or tools like Zillow and Trulia, quickly filling the void left by lack of new home inventory. That is happening right now.

“New home inventory obviously does not work the same way. We were all thankfully surprised by the strong recovery of demand in May but were caught off guard, and it is taking time to ramp up the development machine. Anecdotally, home builders began telling us in September that many of the contracts they were writing would not close until 2021 because production is so far behind.”

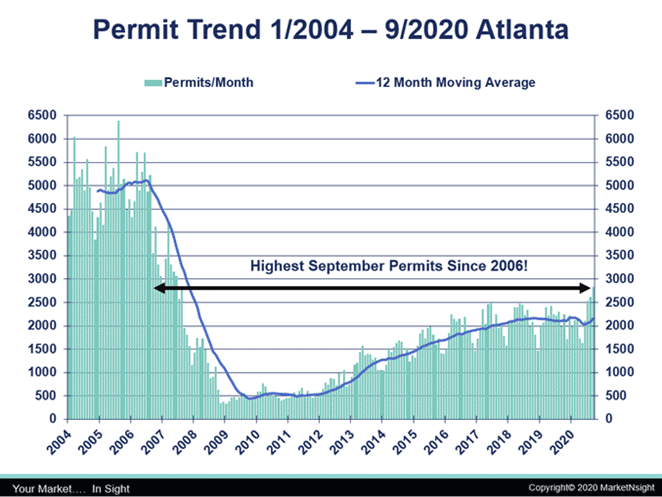

The current environment of ultra-low interest rates and near-zero inventory will be with us for a while regardless of who occupies the White House. These factors will continue to present opportunities to fill pent-up demand with new homes, providing homes can be built at the right price. Permits are starting to increase, just as new pending sales and closings retreat due to lack of supply.

The current environment of ultra-low interest rates and near-zero inventory will be with us for a while regardless of who occupies the White House. These factors will continue to present opportunities to fill pent-up demand with new homes, providing homes can be built at the right price. Permits are starting to increase, just as new pending sales and closings retreat due to lack of supply.

Atlanta is, and has been, in a perpetual state of undersupply for new construction and housing in general, and this may last another decade or longer. The good news is that permits have hit records not seen since 2007 for the last three months. The bad news is, that it is not enough.

Since 2019, the 12-month permit moving average has been basically flat. The pandemic caused a steep drop in the year-to-date, year-to-year percent change, but since bottoming in May at -14%, it has improved steadily and was back to even with 2019 in September.

“I believe this upward trend will continue and we could end 2020 up 5% to 10% over 2019,” Hunt said. “Pretty amazing in the midst of a pandemic.”

MarketNsight is focused on helping home builders and developers make smart decisions related to purchasing land and pricing product. Its groundbreaking Feasibility Matrix® systemizes the decision-making process and creates a one-stop-shop for gauging new home community feasibility including ranking by builder and subdivision and developed lot and raw land sales.

To learn more or to schedule a demonstration, visit www.MarketNsight.com.