MarketNsight recently announced a state of the Atlanta new home market at April’s month-end. Compared to the same four months of data in 2019, the final results of January through April 2020 are almost a wash.

“Sales from January 2020 through the first week of March 2020 were so exceptional that it has compensated for the negative effects of COVID-19 (coronavirus) that we have experienced from the second week of March on,” MarketNsight Principal John Hunt said.

“Sales from January 2020 through the first week of March 2020 were so exceptional that it has compensated for the negative effects of COVID-19 (coronavirus) that we have experienced from the second week of March on,” MarketNsight Principal John Hunt said.

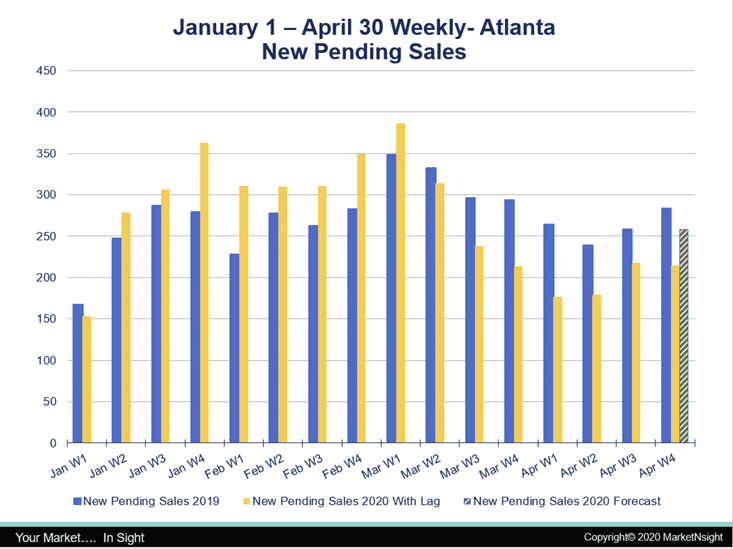

According to Hunt, with this update being so close to the end of April, there is a data lag in week four of the month. He is reporting the actual data with the lag, and also giving a forecast accounting for the gap.

The Big Picture

MarketNsight data shows that even with a lag in the fourth week of April 2020, new pending sales in Atlanta totaled 4,306 from January to April 2020. That compares to a total of 4,342 new pending sales in 2019 from January to April.

“That means new pending sales in Atlanta for January through April 2020 are only down 1% from last year,” Hunt said. “When the lag is accounted for, we will essentially be on par with 2019.”

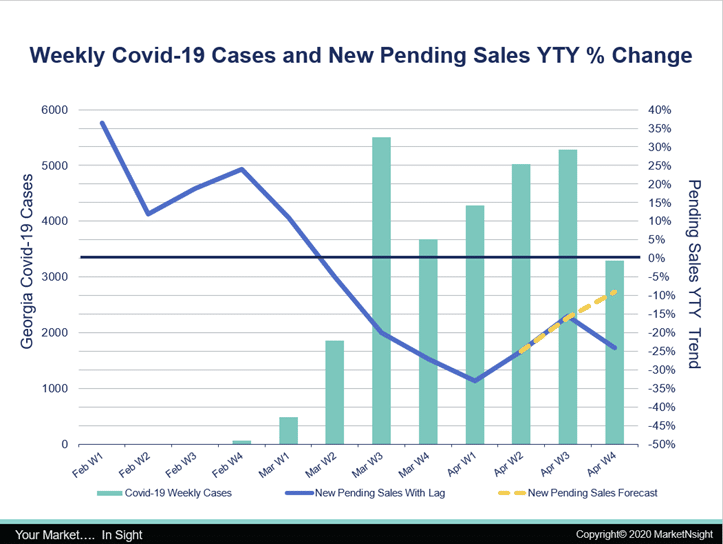

New Pending Sales YTY Change with Covid-19 Georgia Cases

MarketNsight has graphed weekly coronavirus cases and the year-to-year percent change for new pending sales through the fourth week of April.

of April.

“The numbers show we appear to have found a bottom in the first week of April,” Hunt said. “With a lag, the last week of April was 24% below the same week last year.

“Accounting for the lag, the last week of April looks to be down only 9% from the same period last year. With the lag accounted for, the entire month of April in 2020 will be down 20% over April last year.”

New Pending Sales January through April 2019 versus 2020

New homes were selling well from the beginning of 2020 through the first week of March. New pending sales were up 16% year-to-year at that point. From the second week of March to the end of April (accounting for the lag), new pending sales were down 19% year-to-year.

Looking Forward

“If you read this and find yourself in a state of shock, you are not alone,” Hunt said. “Keep in mind that this is data for the entire 26-county Atlanta metro. Every submarket (for example, 305 different high school districts) and price can be experiencing this pandemic differently.

“Also bear in mind that housing and the economy were in an exceptional place when this crisis started,” Hunt said. “Unlike the 2008 recession where every player was over leveraged, overpriced and had far too many lots and spec homes, the fundamentals today are sound.”

Through February 2020, the Atlanta market experienced record job growth, population growth, household formation, in-migration, extremely low lot and home inventories and moderate price inflation, according to Hunt.

MarketNSight is focused on helping home builders and developers make smart decisions related to purchasing land and pricing product. Its groundbreaking Feasibility Matrix® systemizes the decision-making process and creates a one-stop-shop for gauging new home community feasibility including ranking by builder and subdivision and developed lot and raw land sales.

To learn more or to schedule a demonstration, visit www.MarketNsight.com.