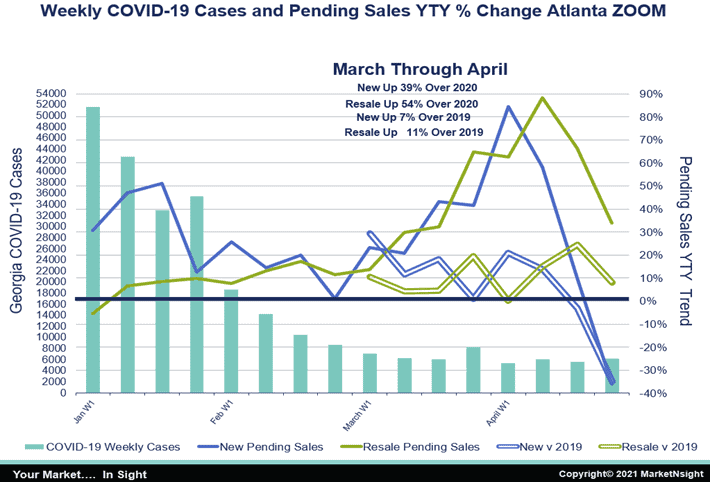

Wondering if there is a resale bubble? Or perhaps the Atlanta housing market is back to normal? MarketNSight recently presented at the in-person Greater Atlanta Home Builders Association Board of Directors meeting. At the event, the firm compared Atlanta’s pendings for new and resale from March through April 21, 2021, to the same period the year before. Since March through April 2020 saw the worst part of the pandemic’s effect on demand, MarketNsight also looked at pendings for new and resale for 2021 as compared to 2019 – a more normal year. Compared to 2019, new and resale increased by 13% and 11% respectively. Then, came the last week in April of this year.

Atlanta New Pending Sales YTY Change with COVID-19 Georgia Cases

“You can see in the chart below that the solid lines for new and resale YTY pendings began this year in positive territory and then, exploded up when comparing to March and April of last year, which were horrible,” MarketNsight Principal John Hunt said.

When comparing March through April 2021 to the same period of 2019 (the hollow lines), the area was initially positive or flat through the third week in April. Then, the bottom fell out for new pending home sales. The last time new pendings were down more than 30% YTY was the first week of April last year, and that was the bottom of the pandemic effect. What is more shocking is that new pendings were also minus 30%+ against the same week in April 2020.

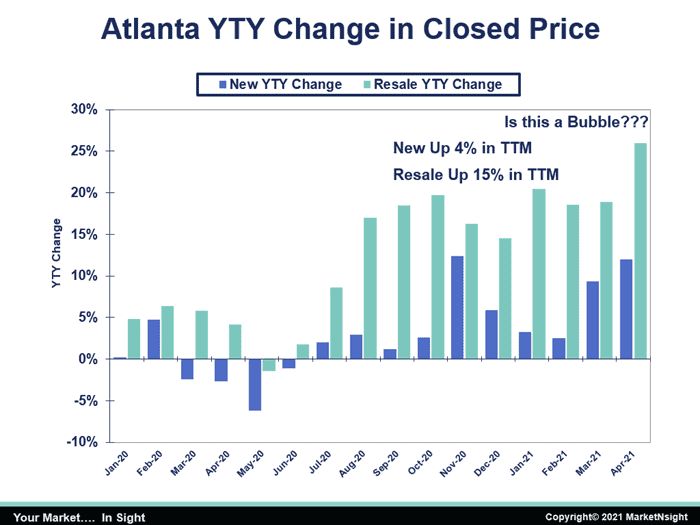

Are Atlanta’s Resales in a Bubble?

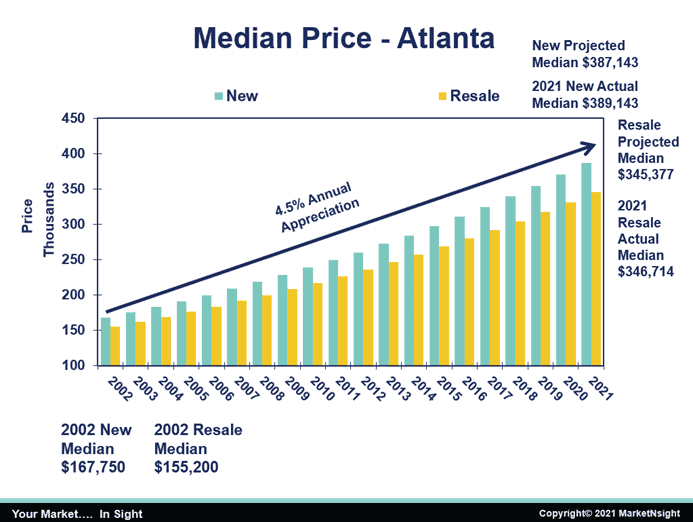

It certainly looks like it in the chart below, especially for resale. These resale price increases are unprecedented, to make use of an overused phrase. However, in this case, it is actually true. Normally, housing appreciates each year between 4 and 5%. These are not normal times. In fact, Atlanta’s last “normal” year was in 2002 – 20 years ago. Since the resale price increased over the last 12 months, it absolutely feels like a bubble.

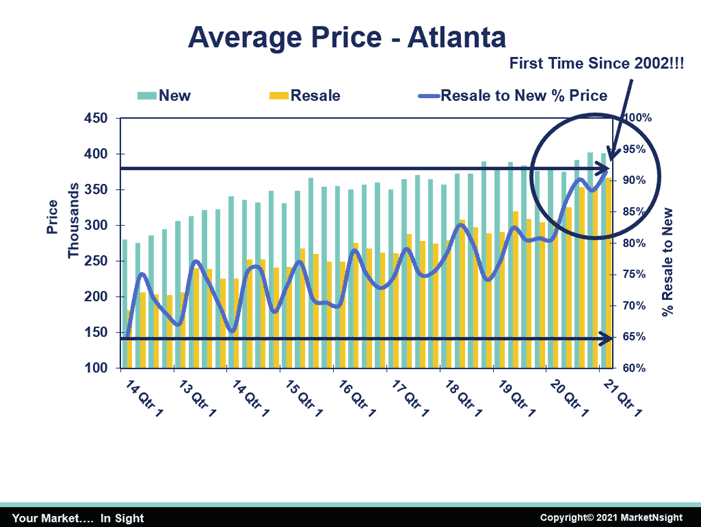

Housing’s Last “Normal” Year – 2002

Leading up to 2002, the same metrics ruled for almost a decade and they produced the same results year after year. The metrics were a 10% new/resale price spread, 45,000 to 50,000 new permits and a 40% market share for new against resale. After 2002, everything changed as subprime/Alt A loans flooded the marketplace. The result was a yearly 15 % average lot price increase from 2002 to 2007 – which is three times the normal rate of appreciation for five straight years. The price spread between new and resale rose above 20% for the first time in the third quarter of 2006. Most in the industry, at that time, will say that it was the beginning of the end for new homes.

“Carnage ensued, and we did not find a bottom in housing until 2011,” Hunt said.

That year’s metrics were a 65% new/resale price spread, 6,000 new permits and an 11% market share for new against resale. Good news! As seen in the chart below, the first quarter of 2021 for new/resale price spread is back to about 10%. This was only accomplished with the very high resale appreciation over the last 10 months. It took 20 years to get back to that “normal.”

How About Another Reason Atlanta May Not Be in a Bubble Yet?

With 2002 as a baseline, the chart below shows that the market is almost exactly where it should be if, hypothetically, new and resale median prices appreciate at 4.5% for the 20-year span.

So, the market will begin to see some sharp moderation in resale prices over the next few months. If not, all bets on a resale price bubble are off.

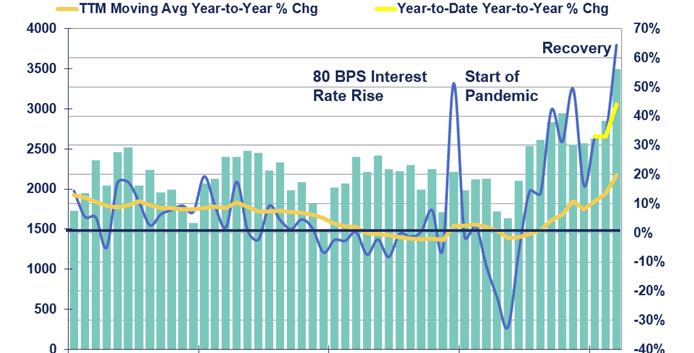

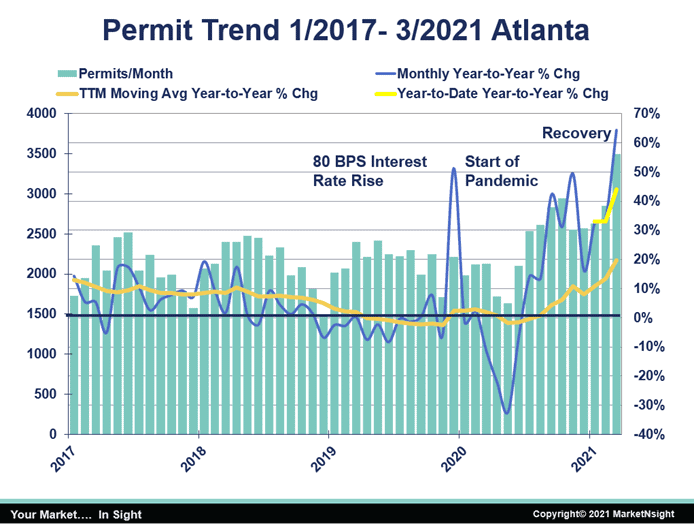

Permits Are Up Big

2020 ended with permits up 6% over 2019, falling just short of the forecasted 10% increase. Currently, Atlanta’s first quarter permits are up 44% YTD.

“Is that sustainable for the rest of the year? Most assuredly not,” Hunt said. “But what will permits do in 2021 over 2020?”

Virtual MarketWatch Atlanta is Wednesday, June 9

These topics will be discussed during the virtual MarketWatch event on June 9. John Hunt will be joined by guest speaker Dr. Rajeev Dhawan from the Georgia State University Economic Forecasting Center. Please make plans to attend!

MarketNsight is focused on helping its customers make smart decisions as it relates to purchasing land and pricing product. Its groundbreaking Feasibility Matrix provides a one-stop shop for gauging new home community feasibility by providing ranking reports, lot and raw land sales data, regression analysis and mortgage data.

To learn more or to schedule a demonstration, visit www.MarketNsight.com.