A new report from ATTOM Data Solutions reveals that nearly one in 10 homes sold so far in 2018 by the nation’s two leading iBuyers – Opendoor and Offerpad – were purchased by institutional investor entities buying at least 10 homes. Although overall investor sales are down dramatically, more sales transactions for this group take place through iBuyers. Investor sales being down in Atlanta and other metro cities makes sense because the glut of low priced, foreclosed homes are long gone and market rate homes aren’t as enticing for flippers or investors looking to rent.

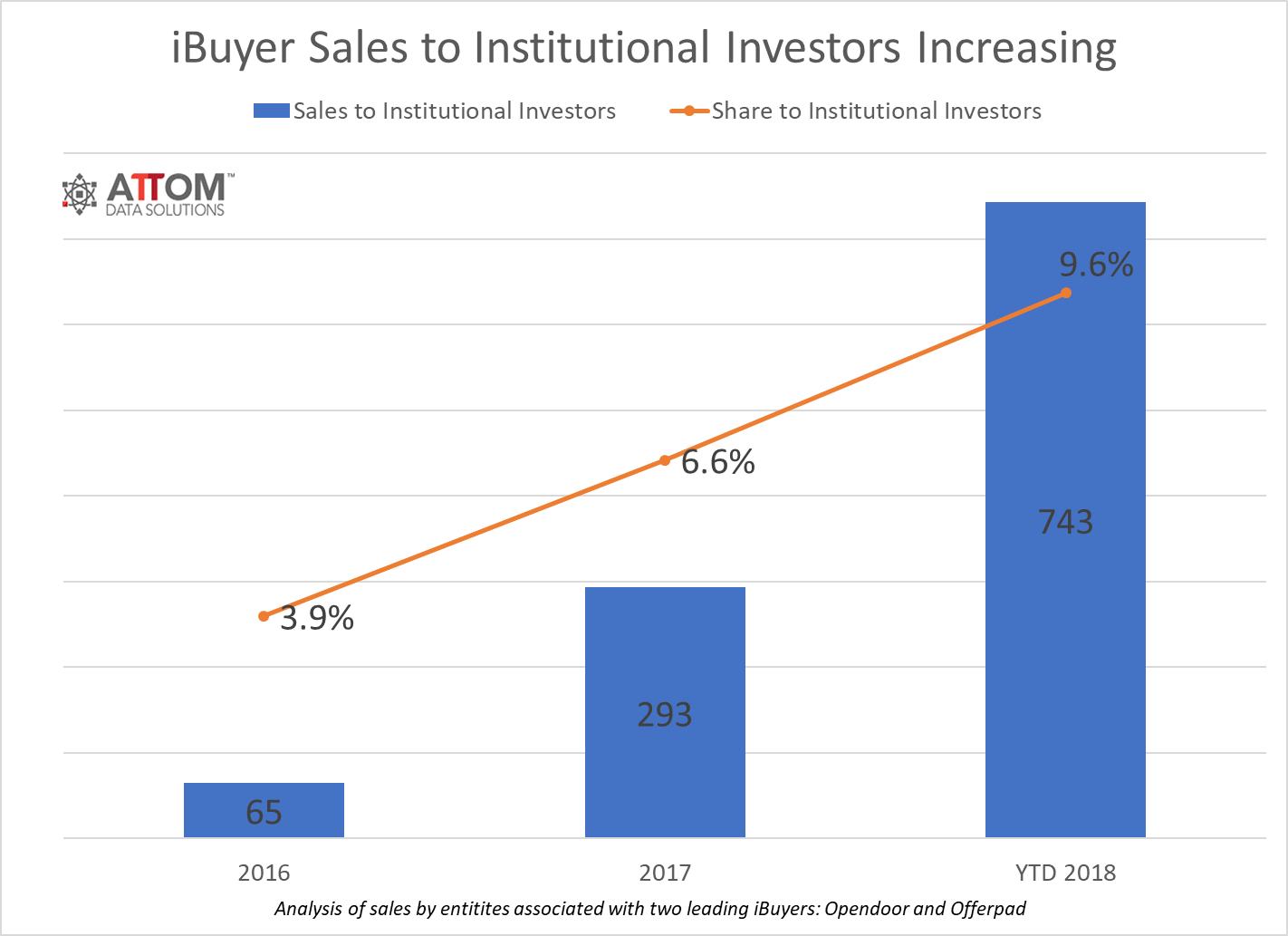

A total of 743 homes sold by the two companies or 9.6 percent of all sales by those two iBuyers – companies that buy directly from homeowners through all-cash offers – were to institutional investors, up from 293 homes or 6.6 percent in 2017 and 65 institutional investor purchases or 3.9 of the two iBuyer companies’ sales in 2016.

A total of 743 homes sold by the two companies or 9.6 percent of all sales by those two iBuyers – companies that buy directly from homeowners through all-cash offers – were to institutional investors, up from 293 homes or 6.6 percent in 2017 and 65 institutional investor purchases or 3.9 of the two iBuyer companies’ sales in 2016.

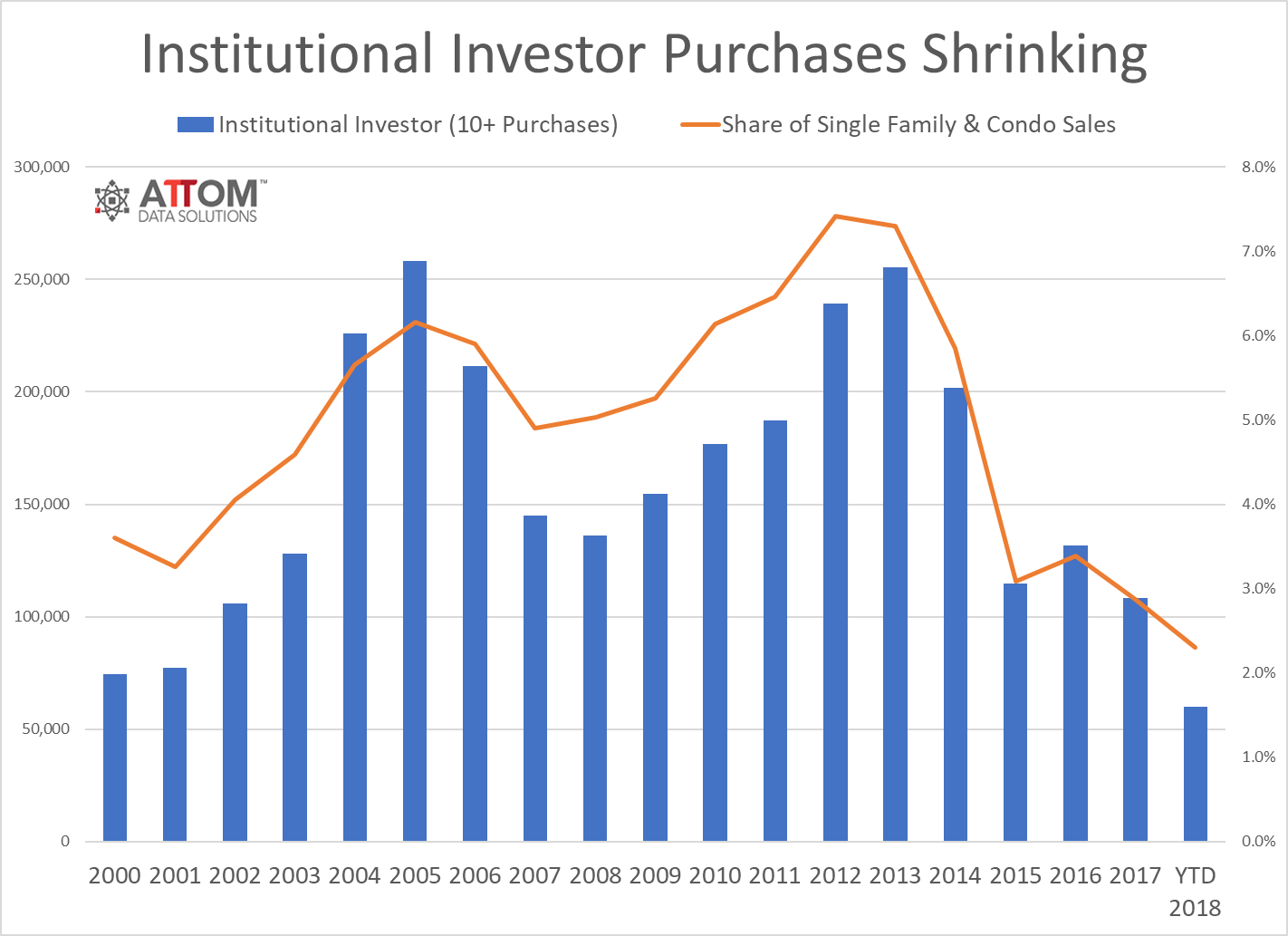

The three top institutional buying entities are Cerberus Holdings LP, CSH Property One LLC, and TAH Holding LP, which all appear to be related to companies purchasing single-family homes as rentals. Institutional investors are likely turning to iBuy companies as a source of inventory as other typical inventory sources, such as foreclosures, have largely dried up in recent years. Despite the increase of sales by those companies to institutional investors over the last three years, institutional investor purchases represented just 2.3 percent of all U.S. home sales so far in 2018, down from 2.9 percent in 2017 and a peak of 7.4 percent in 2012.

“There are a lot of buyers, both big and small, looking to grow their single-family rental portfolios and inventory is very tight. This is leading to creative ways to find new product — from build-to-rent programs, off-market inventory programs and iBuyer initiatives,” said Kevin Ortner, CEO with Renters Warehouse, a company that manages more than 22,000 SFR properties in 42 states. “There are several firms positioning themselves to be able to help bring supply to meet the demands of investors, and I expect that will continue to grow. I’m also seeing investment in technology and data across the space allowing greater scale, efficiencies and insights.”

With inventory sitting across metro Atlanta, iBuy companies are a viable option for sellers ready to be out of their old home and into a new one.

“A properly priced rental home today, there is almost limitless demand for it,” said Gary Beasley, CEO and co-founder with Roofstock, an online marketplace for SFR properties that itself is working on ways to create SFR inventory for both retail buyers and institutional buyers. “We have to get creative about how to attract this inventory, and if it isn’t available to create it.”

To compile the report, ATTOM Data Solutions analyzed public record sales deed data from its nationwide property data warehouse for sales by entities associated with Opendoor and Offerpad, broken down by purchase entity. Purchase entities that bought at least 10 homes from the two iBuyers combined were considered institutional investors. For overall home sales, ATTOM considered any entity buying 10 or more properties in a calendar year as an institutional buyer.