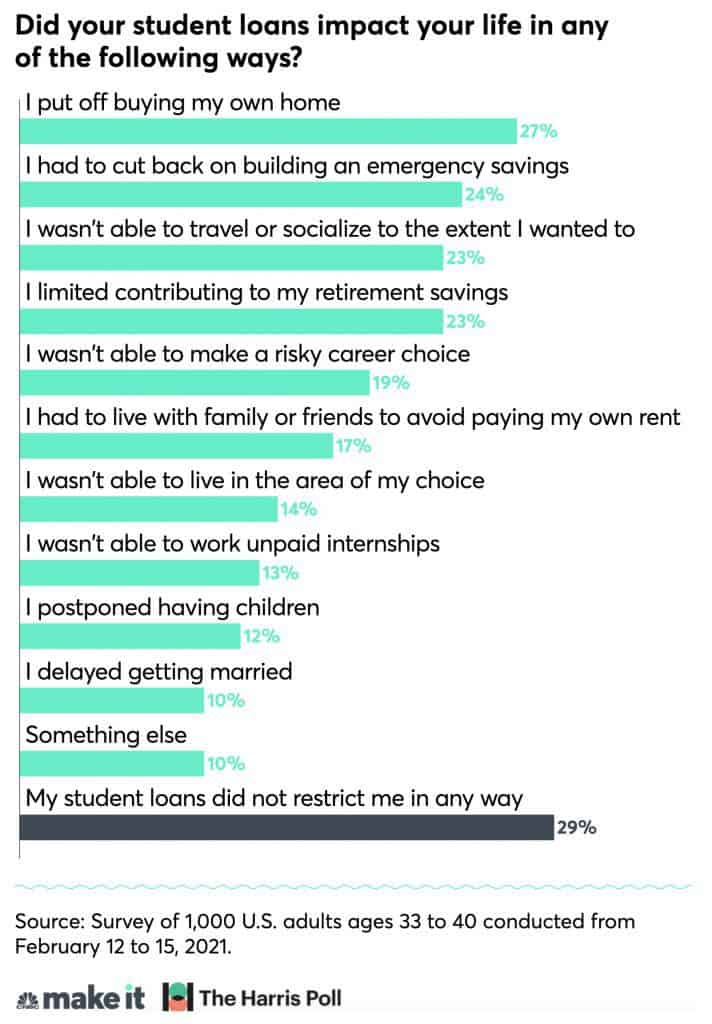

The rise in student loan debt is a constant subject on the news, and it is often listed as one of the main reasons why Millennials are slow to enter the housing market. Statistics from a recent survey conducted by The Harris Poll on behalf of CNBC Make It show that U.S. adults age 33 to 40 have an average of $21,880 in student loans. And only 32% of those have paid them off, meaning the majority (68%) of older millennials are still paying student loans a decade after graduating from college.

FHA Makes Changes to Student Loan Debt

But there is good news! As of Thursday, June 17, 2021, the Federal Housing Administration (FHA) is changing the way it reviews an applicant’s student loan debt. This change is an attempt to help entry-level ,first time homebuyers and close the racial homeownership gap, Prior to the change, the FHA made the assumption (always a bad idea, right) that all borrowers only paid 1% of their student loans each month. The problem with this assumption is that it inflated the debt-to-income ratio of many potential homebuyers who were paying substantially more each month than 1%.

Under the new policy, FHA abandons the 1% assumption in favor of a calculation that better reflects what borrowers actually pay monthly. The changes are a victory for such groups as the Mortgage Bankers Association, which say the existing policy has imposed undue roadblocks on home buyers.

Tips for Getting a Mortgage

While it’s true that student loan debt can make it harder to obtain a mortgage, it may not be as big a detriment as many Millennials think. When determining your debt-to-income ratio, lenders look at the amount you pay out toward your debt each month, not the overall amount of debt you have in your name.

Typically, if your debt-to-income (DTI) ratio is more than 43 percent of your overall income, it will significantly decrease your chances of receiving a loan. This means that your total student loan, auto, credit card and mortgage payments should equal less than 43 percent of your total monthly income.

If your DTI ratio is above 43 percent, read the full article on the Equifax Finance Blog for tips on reducing your monthly debt payments. Planning ahead and possessing smart financial skills can help you be prepared when you’re ready to purchase your first home in Atlanta.