ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), recently released its first-quarter 2020 report highlighting the United States home sales trend. Most notably, the report shows that home sellers saw a home price gain of $67,100. This is up from a gain of $66,264 when compared to the fourth quarter of 2019. It is also up significantly when compared to the first quarter of 2019 which saw a home price gain of $59,000.

The increase in home-seller profit accounted for over 33% return on investment when compared to its original purchase price. This is higher when compared to one year ago, but lower when compared to the fourth quarter of 2019.

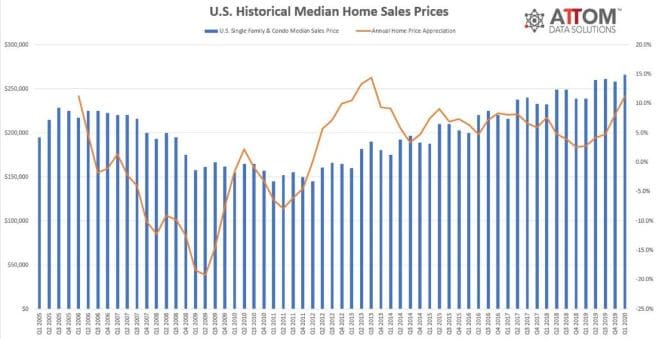

In addition to the rising home price gain, the report also shows that the median price for single-family homes and condos are on the rise. The first quarter of 2020 reflected a high of $265,900 median home price. This is up almost 3% when compared quarter-by-quarter and over 11% year-over-year. This increase in home prices is the largest since late 2013.

“The national housing market continued at full throttle in the first quarter of 2020, setting new price and profit records as it entered its ninth straight year of gains,” said Todd Teta, chief product officer at ATTOM Data Solutions. “After it looked like things were settling down last year, the market has again roared ahead, with significant increases.”

Although the housing market is pushing forward, Teta noted that it is important to remember the momentum will most likely hit a wall and reverse later this year. The COVID-19 (coronavirus) pandemic resulted in a drastic economic slowdown. Americans are facing unemployment, furloughs, social distancing and self-isolation measures. These factors are most likely to be reflected on the home sales trend moving into spring.

To stay up-to-date with coronavirus on Atlanta Real Estate Forum, click here.

To read more from ATTOM Data Solutions on Atlanta Real Estate Forum, click here.