ATTOM, curator of the nation’s premier property database, released its 2Q2021 U.S. Home Affordability Report, showing that median home prices of single-family homes and condos in the second quarter of this year are less affordable than historical averages in 61 percent of counties across the nation with enough data to analyze. That was up from 48 percent of counties in the second quarter of 2020, to the highest point in two years, as home prices have increased faster than wages in much of the country.

The report determined affordability for average wage earners by calculating the amount of income needed to meet monthly home ownership expenses — including mortgage, property taxes and insurance — on a median-priced single-family home, assuming a 20 percent down payment and a 28 percent maximum “front-end” debt-to-income ratio. That required income was then compared to annualized average weekly wage data from the Bureau of Labor Statistics (see full methodology below).

Historical levels versus media prices

Compared to historical levels, median home prices in 347 of the 569 counties analyzed in the second quarter of 2021 are less affordable than past averages. The latest number is up from 275 of the same group of counties in the second quarter of 2020 – a backslide that developed amid a 22 percent spike in the median national home price over the same period last year to a record of $305,000.

While major ownership costs on median-priced homes do remain within the financial means of average workers across the nation in the second quarter of 2021, the percentage of counties where affordability is worse than historical averages has hit its highest point since the second quarter of 2019.

While major ownership costs on median-priced homes do remain within the financial means of average workers across the nation in the second quarter of 2021, the percentage of counties where affordability is worse than historical averages has hit its highest point since the second quarter of 2019.

Homes are getting less affordable

The latest pattern – home prices still manageable but getting less affordable – has resulted in major ownership costs on the typical home consuming 25.2 percent of the average national wage of $63,986 in the second quarter of this year. That is up from 22.7 percent in the first quarter of 2021 and 22.2 percent in the second quarter of last year, to the highest point since the third quarter of 2008. Still, the latest level is within the 28 percent standard lenders prefer for how much homeowners should spend on mortgage payments, home insurance and property taxes.

Those mixed trends in the second quarter have developed during a 12-month period in which a glut of home buyers chasing a tight supply of homes for sale has spiked prices in most parts of the nation. The surge has come amid rock-bottom home-mortgage rates and a desire of many households largely untouched by the financial damage caused by the worldwide Coronavirus pandemic to seek the relative safety of a house and yard and more space for developing work-at-home lifestyles. Mortgage rates below 3 percent have helped cushion the impact of rising prices, but not enough to prevent the cost of home ownership from getting closer to the unaffordable benchmark.

“Average workers across the country can still manage the major expenses of owning a home, based on lender standards. But things have gone in the wrong direction this quarter in a majority of markets as the national housing market boom roars onward,” said Todd Teta, chief product officer with ATTOM. “While super-low mortgage rates have certainly helped in a big way, prices have simply shot up too much to maintain historic affordability levels. The near future of affordability remains very uncertain, as it has throughout the pandemic. ATTOM continues to watch those trends closely. For the moment, the situation is a mix of positive and negative trends.”

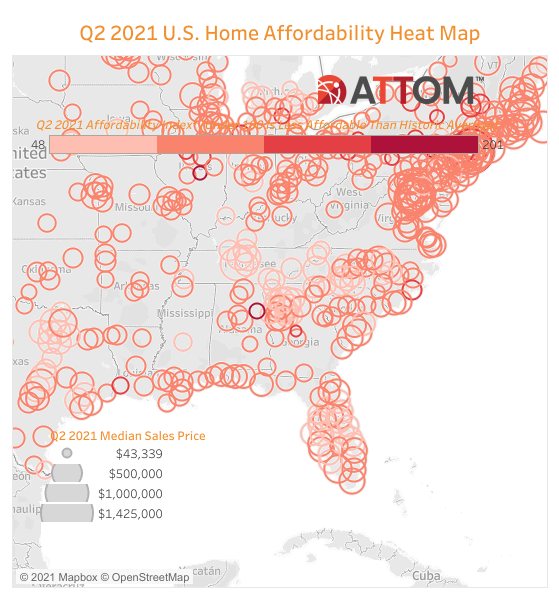

View Q2 2021 U.S. Home Affordability Heat Map

A majority of markets still require less than 28 percent of wages to buy a home

Major ownership costs on median-priced homes in the second quarter of 2021 consume less than 28 percent of average local wages in 327 of the 569 counties analyzed in this report (57 percent).

Counties requiring the smallest portion are Schuylkill County, PA (outside Allentown) (5.5 percent of annualized weekly wages needed to buy a home); Bibb County (Macon), GA (8 percent); Cambria County, PA (outside Pittsburgh) (8.2 percent); Macon County (Decatur), IL, (9.1 percent) and Peoria County, IL (10.4 percent).

Among the 43 counties in the report with a population of at least 1 million, those where home ownership typically consumes less than 28 percent of average local wages in the second quarter of 2021 include Wayne County (Detroit), MI (10.7 percent); Cuyahoga County (Cleveland), OH (12.9 percent); Philadelphia County, PA (18.1 percent); Harris County (Houston), TX (20.2 percent) and Franklin County (Columbus), OH (21 percent).

A total of 242 counties in the report (43 percent) require more than 28 percent of annualized local weekly wages to afford a typical home in the second quarter of 2021. Counties that require the greatest percentage of wages are Kings County (Brooklyn), NY (100.8 percent of annualized weekly wages needed to buy a home); Marin County, CA (outside San Francisco) (81.4 percent); Santa Cruz County, CA (76.2 percent); Queens County, NY (68.7 percent) and Monterey County, CA (outside San Francisco) (65.9 percent).

Aside from Kings County, NY, and Queens County, NY, counties with a population of at least 1 million where home ownership consumes the highest percentage of average annualized local wages in the second quarter include Nassau County, NY (outside New York City) (63 percent); Orange County, CA (outside Los Angeles) (59.2 percent) and Alameda County (Oakland), CA (54 percent).

Home prices up at least 10 percent in almost two-thirds of country

Median single-family home prices in the second quarter of 2021 are up by at least 10 percent from the second quarter of 2020 in 348, or 61 percent, of the 569 counties included in the report. Counties were included if they had a population of at least 100,000 and at least 50 single-family home and condo sales in the second quarter of 2021.

Among the 43 counties with a population of at least 1 million, the biggest year-over-year gains in median prices during the second quarter of 2021 are in San Bernardino County, CA (up 25 percent); Mecklenburg County (Charlotte), NC (up 24 percent); Maricopa County (Phoenix), AZ (up 21 percent); Hillsborough County (Tampa), FL (up 20 percent) and Middlesex County (outside Boston), MA (up 20 percent).

Counties with a population of at least 1 million that have the smallest year-over-year increases (or price declines) in the second quarter of 2021 are New York County (Manhattan), NY (down 21 percent); Wayne County (Detroit), MI (down 2 percent); Bronx County, NY (up 2 percent); Kings County (Brooklyn), NY (up 3 percent) and Santa Clara County (San Jose), CA (up 4 percent).

Price gains outpace wage growth in almost three-quarters of markets

Home-price appreciation is greater than annualized wage growth in the second quarter of 2021 in 409 of the 569 counties analyzed in the report (72 percent), with the largest including Los Angeles County, CA; Harris County (Houston), TX; Maricopa County (Phoenix), AZ; San Diego County, CA, and Orange County, CA (outside Los Angeles).

Average annualized wage growth is outpacing home-price appreciation in the second quarter of 2021 in 160 of the 569 counties in the report (28 percent), including Cook County (Chicago), IL; Kings County (Brooklyn), NY; Bexar County (San Antonio), TX; Santa Clara County (San Jose), CA, and Wayne County (Detroit), MI.

Annual wages needed to afford median-priced home exceed $75,000 in less than 20 percent of markets

Annual wages of more than $75,000 are needed in the second quarter of 2021 to afford the typical home in just 104, or 18 percent, of the 569 markets in the report.

The top 20 highest annual wages required to afford the typical home are all on the east or west coasts, led by San Mateo County (outside San Francisco), CA ($246,090); Marin County (outside San Francisco), CA ($245,914); San Francisco County, CA ($237,588); New York County (Manhattan), NY ($212,246) and Santa Clara County (San Jose), CA ($220,850).

The lowest annual wages required to afford a median-priced home in the second quarter of 2021 are in Schuylkill County, PA (outside Allentown) ($9,055); Cambria County, PA (outside Pittsburgh) ($12,688); Bibb County (Macon), GA ($13,415); Robeson County, NC (outside Fayetteville) ($16,951) and Chautauqua County, NY (outside Buffalo) ($17,977).

Homeownership less affordable than historic averages in almost two-thirds of counties

Among the 569 counties analyzed in the report, 347 (61 percent) are less affordable in the second quarter of 2021 than their historic affordability averages, up from 48 percent of the same group of counties that were less affordable historically in the second quarter of 2020.

Counties with a population of at least 1 million that are less affordable than their historic averages (indexes of less than 100 are considered less affordable compared to historic averages) include Mecklenburg County (Charlotte), NC (index of 77); Dallas County, TX (80); Oakland County, MI (outside Detroit) (81); Fulton County (Atlanta), GA (82) and Tarrant County (Fort Worth), TX (82).

Counties with the worst affordability indexes in the second quarter of 2021 include Delaware County, PA (outside Philadelphia) (index of 48); Rankin County (Jackson), MS (52); Canyon County, ID (outside Boise) (59); Montgomery County (Dayton), OH (63) and Gaston County, NC (outside Charlotte) (67).

Among counties with a population of at least 1 million, those where the affordability indexes worsened annually are Mecklenburg County (Charlotte), NC (index down 14 percent); San Bernardino County, CA (down 14 percent); Wake County (Raleigh), NC (down 11 percent); Hillsborough County (Tampa), FL (down 11 percent) and Maricopa County (Phoenix), AZ (down 11 percent).

Roughly 40 percent of markets are more affordable than historic averages

Among the 569 counties in the report, 222 (39 percent) are more affordable than their historic affordability averages in the second quarter of 2021, down from 51 percent of the same group in the second quarter of last year.

Counties with a population of at least 1 million that are more affordable than their historic averages (indexes of more than 100 are considered more affordable compared to historic averages) include New York County (Manhattan), NY (index of 159); Montgomery County (outside Washington, D.C.), MD (118); Suffolk County, NY (outside New York City) (113); Santa Clara County (San Jose), CA (109) and Fairfax County, VA (outside Washington, D.C.) (108).

Outside of New York County, NY, counties with the best affordability indexes in the second quarter of 2021 include Schuylkill County, PA (outside Allentown) (index of 201); Macon County (Decatur), IL (175); Ontario County (outside Rochester), NY (157) and Bibb County (Macon), GA (155).

Counties with a population of least 1 million residents where affordability indexes improved the most, year over year, are New York County (Manhattan), NY (index up 40 percent); Santa Clara County (San Jose), CA (up 10 percent); Wayne County (Detroit), MI (up 8 percent); Bronx County, NY (up 4 percent) and Kings County (Brooklyn), NY (up 3 percent).

Read our recent article – President Biden Proposes $15,000 Downpayment Assistance

About ATTOM Data Solutions

ATTOM Data Solutions provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population.